Customer Support Representatives have too much on their plate.

Whether you’re making a change to your bank account or reaching out to your wireless provider about a SIM card, identity verification is a major part of ensuring that only authorized people can change your account.

But today’s protection methods aren’t robust enough to stand up to impersonators or properly verify a caller’s identity. Customers can forget passwords or be exposed if a cybercriminal releases their password in a data breach can leave customer accounts wide open to exploitation. And it shows – over the past four years alone, identity theft reports have more than doubled, and general fraud reports have nearly quadrupled.

At Nametag, we’ve been studying today’s threat landscape to enable our partners to formalize their identity verification processes and protect their customers from digital fraud and potential impersonators.

Today’s Customer Experience

As cybercrime continues to escalate, a customer support team can be the only line of defense between a fraudster and your customer’s Personally Identifiable Information (PII) at times.

This puts both your representatives and your customers in a difficult position. While your customers grow frustrated with time-consuming authentication methods and obvious security questions (like birth dates, social security numbers or mothers’ maiden names), your overtaxed Customer Service Representatives aren’t just struggling to meet their efficiency metrics, they are also trying to get their clients the answers and support they need. They’re also unnecessarily anxious about whether callers are who they claim to be.

As fraud grows prevalent, customers are also expressing valid concerns about their digital security. They care about protecting their data and seeking control over what information they’re sharing with companies.

CSRs aren’t fraud detectives. Here are the tools they need.

Nametag’s Multi-Factor Identity technology is designed to streamline your customer support processes while giving your customer support team the speed and security they desperately need. We understand that your Customer Support Representatives aren’t fraud detectives. So we give them the convenient toolkit they need to leverage secure identity verification.

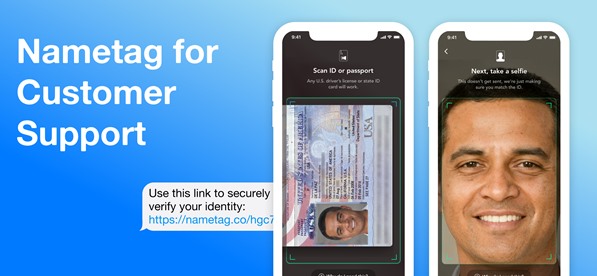

When a customer calls, your team can verify your customer’s identity with a portal designed for their needs. When a support call starts, your customer support representative can generate and send a smart link through text, email or chats. Your customer can almost instantly use a real-time selfie and their government-issued ID to prove that they’re real.

This empowers your reps to save time and offer a better experience to your clients. Minimize friction and drastically reduce fraud with one go-to solution for identity verification.

Looking Ahead

The Nametag team is dedicated to empowering businesses to offer secure identity verification and fraud prevention to their customers. Our solutions are designed to help you eliminate time-consuming, informal authentication that enables criminals and impersonators to steal information and identities. To learn more about how your customer support center can leverage our customer ID portal in minutes, you can schedule a demo with us at the link below.

About the Author

Aaron Painter is the CEO of Nametag Inc, the company who invented “Sign in with ID” as a more secure alternative to passwords. After watching too many friends and family members fall victim to identity theft and online fraud, Aaron assembled a team of security experts to build the next generation of online account protection. Nametag has a mission to bring authenticity to the internet and enable people to build more trusted relationships. They believe security should be centered around you, the user, and that your identity – like your privacy – is a valuable asset worth protecting.